Mafube – yet another Qualified Audit

- MBF

- Nov 14, 2025

- 2 min read

The Municipal Manager of Mafube Local Municipality (MLM) recently gave notice of the availability of the “Draft Annual Report” for the 2023/2024 financial year, for public comment.

While Mafube Business Forum (MBF) welcome MLM’s attempt at transparency, this is once again a concerning example of the lack of urgency and marginalisation of important sections of the Municipal Finance Management Act (MFMA). The deadline for municipalities to table their annual report in council is within seven months after the financial year-end, which is the end of January. A municipality must make its annual report public immediately after it is tabled in the council. The public can then submit representations on the report, and the council must consider it within two months of being tabled.

A municipality’s Annual Report should thus be “signed off” at the end of March each year, in order for the municipal management to focus on its service delivery budget implementation plan (SDBIP).

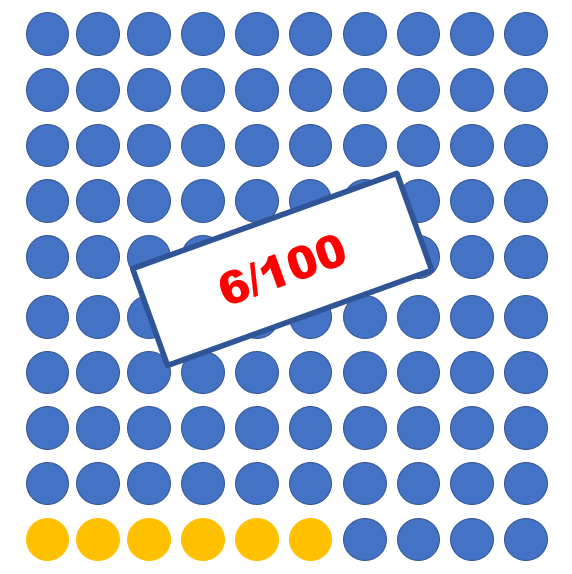

In her foreword to the Annual Report, the Municipal Manager, Ms. J.B Selapyane confirms that MLM have once again received qualified audit opinions for the 2022/2023 and 2023/24 financial years from the Auditor-General’s office. Statements for both financial periods were submitted late.

A Qualified Audit: What does it mean?

The Auditor-General (AG) has found problems in specific areas of the financial statements but believes that, overall, the financial information is reliable. Common causes for a Qualified Audit include instances where the AG was unable to gather enough evidence to verify certain transactions or accounts and/or the AG disagrees with the municipality's accounting methods or disclosures, for instance the financial statements do not comply with Generally Accepted Accounting Principles (GAAP), such as an incorrect inventory valuation.

Why the AG's Qualified Audit findings matter

Even though in the view of Mafube Business Forum (MBF), a “clean”, Unqualified Audit remains a non-negotiable, must-achieve for MLM, a qualified report highlights areas for the municipality to attend to. Investors may view a qualified audit with concern, potentially affecting their perception of the municipality's financial health, management capacity and financial discipline. Residents, business owners and ratepayers similarly view the Audit

outcome with concern, since it involves expenditure of public funds, whether locally-sourced or from national grants, ultimately paid for by taxpayers. It also raises concern about possible maleficence.

A consultant appointed at R5,29-million?

A Qualified Audit outcome is also unacceptable in the view of MBF, when considering that a consultant was appointed at R5,29-million to prepare the financial statements prior to submission to the AG’s office, which evidently was only on 25 March 2025 – 7 months after the legislated date. The late submission of the financial statements constitutes non-compliance with the Municipal Finance Management Act (MFMA). The non-compliance

is reported as a material finding in the auditor’s report. The use of consultants is contrary to the direction of National Treasury who is sure to question why the Chief Financial Officer (CFO) of MLM was incapable of preparing the municipality’s financial statements. This should surely be part of a CFO’s ordinary duties, particularly if that CFO

receives an annual remuneration with benefits, in excess of R1-million.

Visit our MBF offices at 18A Church Street, Frankfort, or contact us at 079 145 4295, info@mafubebf.org, www.mafubebf.org

Comments